Mining DECODED

Previous edition: 14 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

OceanaGold Philippines raises $106m in IPO

Proceeds from the offering are earmarked for the repayment of OceanaGold's debt.

OceanaGold Philippines (OGPI), a subsidiary of OceanaGold, has completed its initial public offering (IPO) on the Philippines Stock Exchange, raising $106m (6.13bn pesos).

This move involved the sale of 20% of OGPI's outstanding common shares, a requirement under the renewed Financial or Technical Assistance Agreement for its Didipio Mine operations.

The IPO was a secondary offering, with the final price set at 13.33 pesos per share, totalling 6.08bn pesos for 456 million shares.

The proceeds from the offering, after deducting fees and taxes, will be utilised for paying down OceanaGold's debt, which stood at $160m as of 31 March 2023.

OceanaGold’s decision to list OGPI's shares was first announced in April this year.

In January this year, OceanaGold executed a sale and purchase agreement (SPA) with Tasman Mining (Tasman), a subsidiary of Federation Mining, to acquire OceanaGold's interest in the Blackwater project in New Zealand.

After receiving official notice from Tasman to exercise its exclusive option on Blackwater, which has been held under a project deed since July 2018, the SPA was executed.

As per the agreement, OceanaGold will receive $30m in cash upon completion of the transaction.

The company noted that the SPA is subject to a number of conditions including regulatory approval and is expected to close this year.

OceanaGold is a gold mining and exploration company based in Vancouver, Canada.

In December 2022, OceanaGold received a supplementary environmental impact statement record of decision from the US Army Corps of Engineers for its Haile underground mine in South Carolina, US.

Latest news

Freeport signs deal to earn into Max's Cesar project in Colombia

Freeport has the option to invest C$50m ($36.57m) in cumulative expenditures and make cash payments totalling C$1.55m to secure its stake.

India's electoral bonds scheme reveals Vedanta's link with political parties

Indian mining company Vedanta Group is among the top donors to political parties in India through the opaque electoral bonds scheme, which the country's Supreme Court has deemed unconstitutional. This has revealed the company's close ties with political parties and the Indian Government.

Buxton to acquire Matrix Manganese Project in Arizona, US

The company has agreed to invest A$1m ($660,220) over two years to earn full ownership of 154 BLM Lode Mining claims.

Horizon Minerals seals gold toll milling agreement with FMR

The processing will start from the December 2024 quarter at FMR's Greenfields Mill in Western Australia (WA).

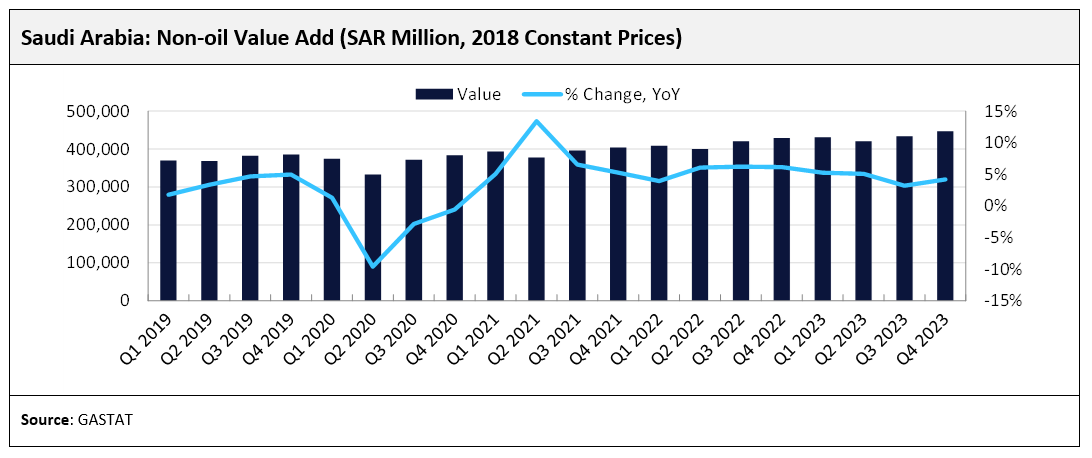

Mining sector to play pivotal role in Saudi Arabia's economic diversification efforts

Saudi Arabia’s non-oil sector accounted for over 50% of GDP for the first time in 2023, with its share rising from 47.4% in 2015 to 51.7% that year.

In our previous edition

Mining Decoded

Australian miners power ahead with equipment electrification

13 May 2024

Mining Decoded

Australia invests A$566m to map mineral deposits, energy sources

10 May 2024

Mining Decoded

Standard Lithium partners with Equinor on sustainable lithium extraction

09 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Banking & Payments

Construction

Foodservice

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer