Mining DECODED

Previous edition: 09 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

Standard Lithium partners with Equinor on sustainable lithium extraction

Equinor will invest up to $160m (Nkr1.75bn) and will secure a 45% stake in Standard Lithium's projects in south-west Arkansas and east Texas.

Standard Lithium has announced a strategic partnership with Equinor, which will see an investment of up to $160m to advance sustainable lithium projects in Arkansas, US.

This collaboration aims to leverage Standard Lithium's DLE expertise and Equinor's project execution capabilities.

Under the agreement, Equinor will invest up to $160m, securing a 45% stake in Standard Lithium's projects in south-west Arkansas and east Texas properties (projects).

The investment includes a $30m cash payment to Standard Lithium at closing and a $60m work programme funded by Equinor. This programme includes a $33m carry for Standard Lithium's portion and $27m for Equinor's share in the projects.

Upon positive final investment decisions by both parties, Standard Lithium could receive up to $70m in additional payments.

Standard Lithium CEO Robert Mintak said: “This partnership with Equinor is a major accomplishment for Standard Lithium. It has long been our belief that success in this sector hinges on strategic partnerships with companies who share our vision and bring complementary strengths.

“Equinor’s culture and values align with ours in using innovation, integrity and responsible development to enable the global energy transition.

“With this partnership, we have the opportunity to accelerate our progress and carve out a significant role in shaping the future of sustainably produced lithium.”

The ownership split of the projects will be 55% for Standard Lithium and 45% for Equinor, with Standard Lithium maintaining operational control.

The partnership is poised to combine Standard Lithium's proprietary DLE process with Equinor's experience in subsurface assessment and production.

This alliance is expected to significantly mitigate project execution risks, particularly in the development phase at the south-west Arkansas site.

The deal not only bolsters Standard Lithium's financial standing but also ensures that the agreed project development expenses will be carried without diluting the value for existing shareholders.

Equinor New Business and Investments in Technology, Digital and Innovation senior vice-president Morten Halleraker said: “We are looking forward to developing these opportunities in the Smackover Formation together with Standard Lithium.

“With Standard Lithium as operator and by building on Equinor's core competencies such as subsurface and project execution capabilities, we believe that more sustainably produced lithium has growth potential and will be an enabler for the energy transition.”

Latest news

Aurubis reports growth in first half core profit

Revenues fell from €8.78bn to €8.25bn, primarily driven by lower copper prices and a significant reduction in shapes sales.

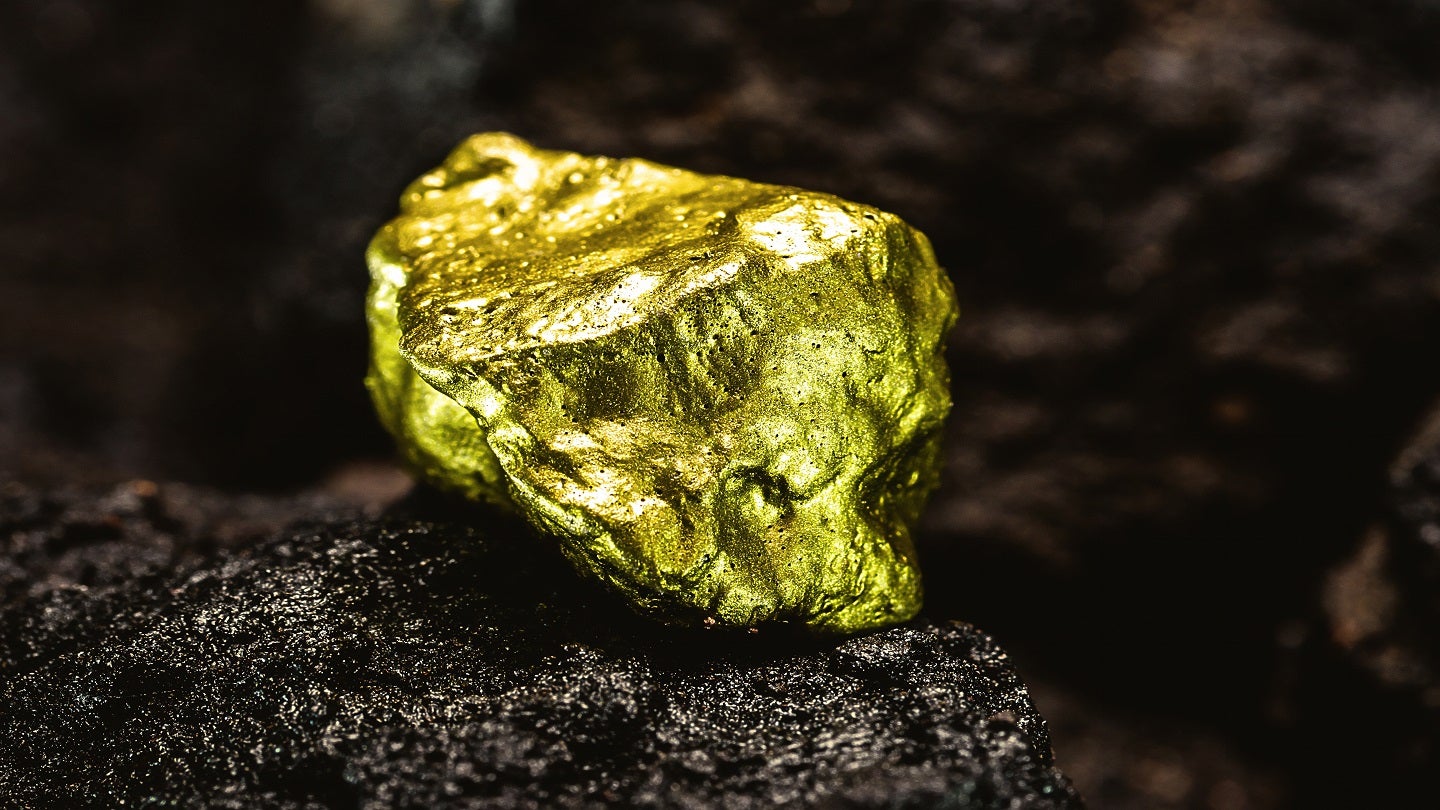

BTU Metals to acquire two Ontario gold exploration projects

BTU Metals has announced the acquisition of a 100% interest in two gold exploration projects in the Wawa gold area of northern Ontario, Canada.

Heliostar Metals announces LOI for $20m debt facility

Heliostar Metals has announced a letter of intent (LOI) to secure a senior secured debt facility totalling $20m (C$27.48m), with a fixed interest rate of 10%.

Trinex signs deal for majority stake in Gibbons Creek uranium project

Australia’s Trinex Minerals, through its Canadian unit Trinex Lithium (Trinex Canada), has entered a definitive agreement with ALX Resources to acquire up to a 75% stake in the Gibbons Creek Uranium Project in Saskatchewan, Canada.

Ganfeng to acquire Leo Lithium's Mali project stake for $342.7m

Ganfeng Lithium Group has reached an agreement to acquire its partner Leo Lithium's remaining 40% stake in the Goulamina lithium mine in Mali for $342.7m.

De Grey launches A$600m equity raise to fund Hemi project

The entitlement offer aims to raise A$256.1m ($168.19m), while the institutional placement looks to garner around A$343.9m.

In our previous edition

Mining Decoded

Piedmont gets state regulator permit for North Carolina lithium mine

08 May 2024

Mining Decoded

Bonterra Resources raises $8.54m in private placement

07 May 2024

Mining Decoded

Mining sector to play pivotal role in Saudi Arabia's economic diversification efforts

06 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer