06 Feb, 2020 Share of high value deals increased while share of low value deals decreased in North America in Q4 2019

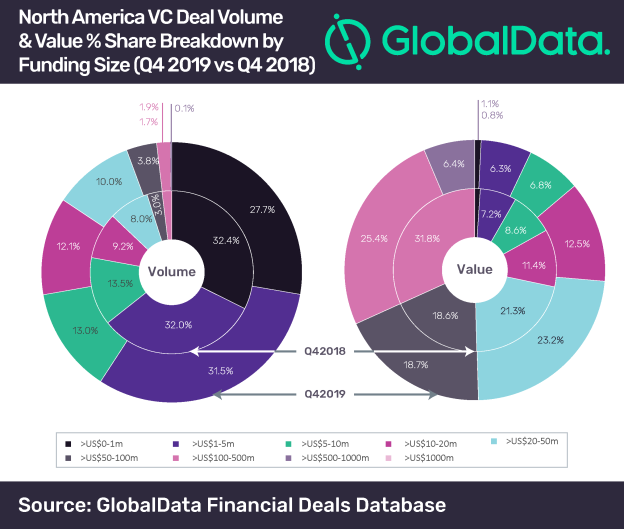

Posted in Press ReleaseThe share of high value deals (investment >US$10m) as a percentage of the total venture capital (VC) deal volume and value increased, while the share of low value deals (investment <=US$10m) decreased in North America in the fourth quarter (Q4) of 2019 compared to Q4 2018, according to GlobalData, a leading data and analytics company.

The share of high value deals as a percentage of the total deal volume and value increased from 22.1% and 83.1% in Q4 2018 to 27.8% and 86.2% in Q4 2019, respectively.

On the other hand, the share of low value deals as a percentage of the total deal volume and value decreased from 77.9% and 16.9% in Q4 2018 to 72.2% and 13.8% in Q4 2019, respectively. Within the low value deals, the highest number of deals were announced in the range of US$1-5m.

IMAGE FOR PUBLICATION: Please click here for enlarged chart

North America witnessed a total of 2,046 deals (with disclosed deal value) worth US$29.1bn in Q4 2019, representing more than 52% and 45% of global VC volume and value, respectively. However, the total VC investment volume and value decreased by 18.5% and 2.7%, respectively, in Q4 2019 compared to Q4 2018.

The number of US$100m+ deals also decreased from 48 in Q4 2018 to 38 in Q4 2019 in North America. On the other hand, the top 50 deals announced during the quarter accounted for more than 35% of total deal value in 2019.

Some of the notable deals announced during Q4 2019 included US$635m funding in Bright Health, US$500m raised by 1debit (Chime) and US$400m each received by Databricks and Convoy.

Ram Kumar Montharapu, Financial Deals Analyst at GlobalData, says: “On the back significant investors’ traction, the US continues to dominate within North America.”

In Q4 2019, the US topped the region with 1,942 deals worth US$28.2bn followed by Canada with 104 deals worth US$885.71m.