17 Feb, 2022 JP Morgan and Rothschild & Co top M&A financial advisers by value and volume in Europe for 2021, finds GlobalData

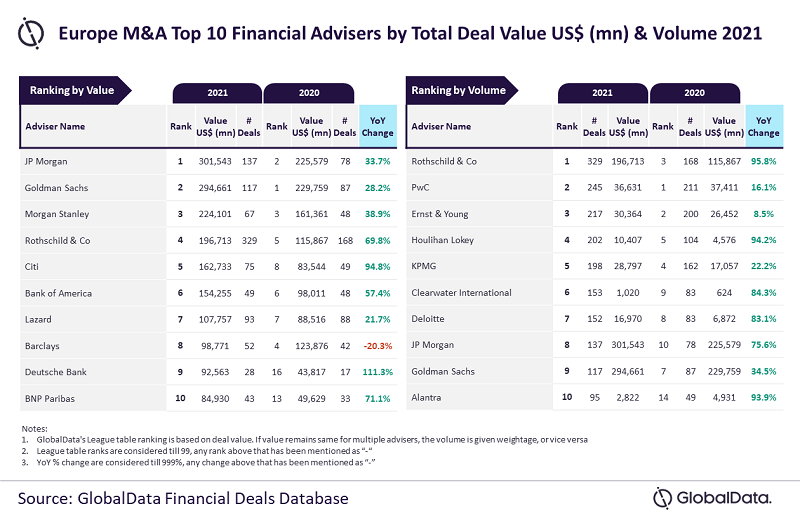

Posted in Business FundamentalsJP Morgan and Rothschild & Co were the top mergers and acquisitions (M&A) financial advisers in Europe for 2021 by value and volume, respectively, according to GlobalData. The leading data and analytics company notes that JP Morgan advised on 137 deals worth $301.5 billion, which was the highest value among all the advisers. Meanwhile, Rothschild & Co led by volume, having advised on 329 deals worth $196.7 billion. A total of 11,842 M&A deals were announced in the region during 2021.

According to GlobalData’s report, ‘Global and Europe M&A Report Financial Adviser League Tables 2021’, deal value for the region increased by 27.6% from $801.3 billion during 2020 to $1 trillion during 2021.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Both JP Morgan and Rothschild & Co were clear winners, outpacing their peers by a large margin. While JP Morgan was the only adviser to cross the $300 billion mark, Rothschild & Co was the only firm that managed to advise on more than 300 deals during 2021.

“Interestingly, Rothschild & Co also managed to secure fourth position by value, and JP Morgan occupied eighth position by volume.”

Goldman Sachs occupied the second position in terms of value, with 117 deals worth $294.7 billion; followed by Morgan Stanley, with 67 deals worth $224.1 billion. Rothschild & Co occupied the fourth position by value, followed by Citi, with 75 deals worth $162.7 billion.

PwC occupied the second position in terms of volume, with 245 deals worth $36.6 billion; followed by Ernst & Young, with 217 deals worth $30.4 billion; Houlihan Lokey, with 202 deals worth $10.4 billion; and KPMG, with 198 deals worth $28.8 billion.